how much tax is deducted from a paycheck in missouri

The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax. No Matter What Your Tax Situation Is TurboTax Has You Covered.

How To Set Up Payroll Taxes In The Quickbooks Desktop Payroll Setup Wizard Youtube

Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined.

. File your taxes stress-free online with TaxAct. There are -699 days left. There is no income limit on Medicare taxes.

You can take advantage of state income tax deductions if you contribute to a MOST 529 Plan account in Missouri to benefit from the current federal tax deductions. Ad Filing your taxes just became easier. Missouri income tax rate.

Any company or corporation violating this requirement shall pay each affected person 50 which can be recovered through court action. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Employers withhold or deduct some of their employees pay in order to cover. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. If they do not Missouri.

Missouri Paycheck Quick Facts. Below is some helpful. Dont let your taxes become a hassle.

In Missouri income tax is levied at 25. If you are married. In Missouri taxpayers can deduct up to 5000 of Federal income tax from their Missouri taxable income for individuals and 10000 for married couples filing jointly.

Missouri Hourly Paycheck Calculator. Work out your adjusted gross. File your taxes at your own pace.

Median household income 58838 US. Ad Receive you refund via direct deposit. The State of Missouri allows a deduction on your individual income tax return for the amount of federal tax you paid.

The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. You can claim a deduction against your taxable income in Missouri if you contribute to an Missouri AND non-Missouri 529 plan up to 8000 per year. Section 143174 RSMo provides a deduction for military income earned as a member of the active duty component of the Armed Forces of the United States.

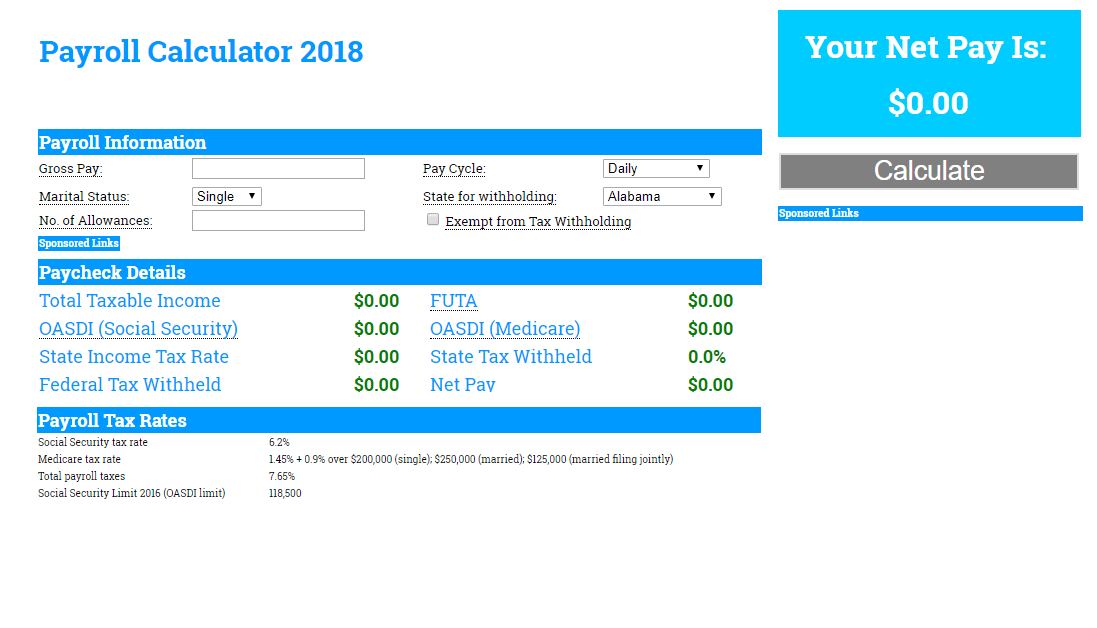

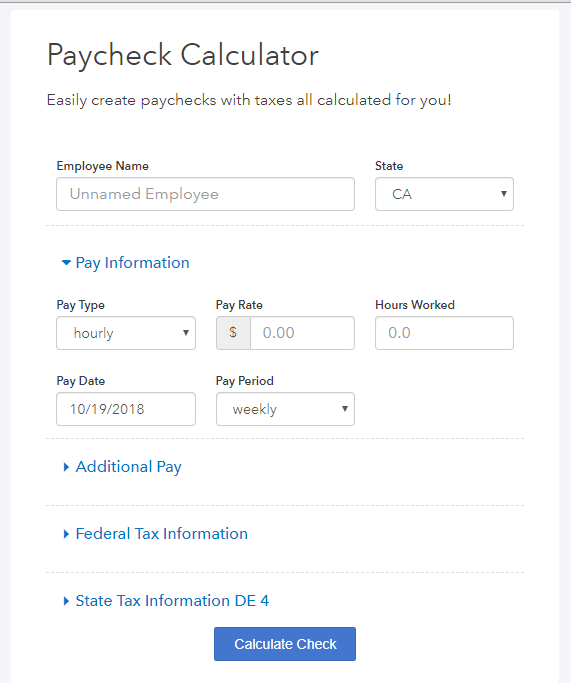

Employers can use the calculator rather than manually looking up. The deduction is for the amount actually paid as indicated on your Federal. Tax regulations require all Missouri filers to take the federal deduction regardless of whether they live together whether in a couple or family unit.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Census Bureau Number of cities that have local income taxes. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. If you make more than a certain. Ad Receive you refund via direct deposit.

An employer may deduct funds from an. The taxable income for the state is the same as. Its a progressive income tax meaning the more money.

Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri. The Missouri bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

2022 Federal State Payroll Tax Rates For Employers

Employment Verification Letter Template Letter Of Employment Letter Templates Employment Letter Sample

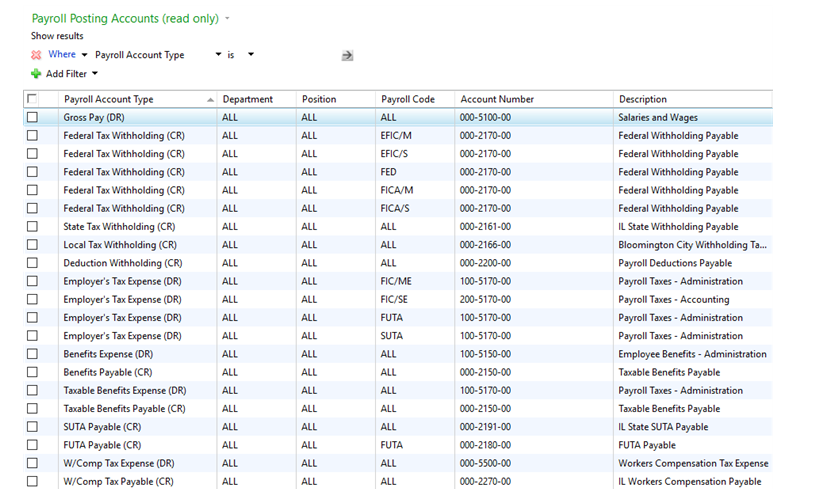

Dynamics Gp U S Payroll Dynamics Gp Microsoft Docs

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Salary Paycheck Calculator Calculate Net Income Adp

Top 6 Free Payroll Calculators Timecamp

Missouri Paycheck Calculator Smartasset

What Can I Deduct From My Employee S Paycheck Exaktime

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Missouri Paycheck Calculator Smartasset

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Fica Tax Changes For 2021 How Will Your Paycheck Change

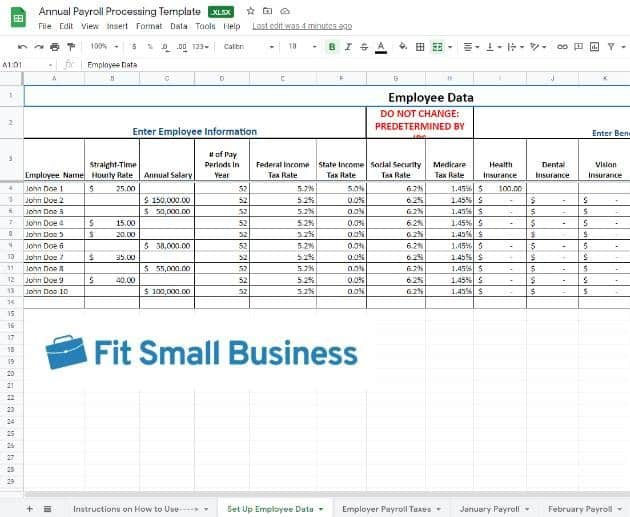

How To Do Payroll In Excel In 7 Steps Free Template

Ready To Use Paycheck Calculator Excel Template Msofficegeek